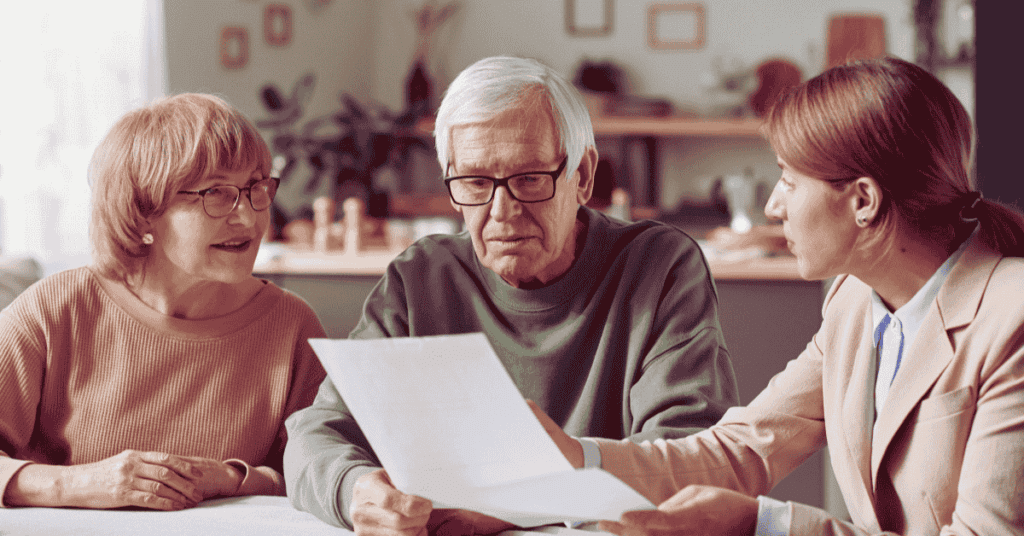

Imagine working hard your whole life, only for your assets to end up in legal limbo because you never made a will. It happens more often than you’d think, and the consequences can be heartbreaking for loved ones left behind. When my friend lost her father unexpectedly, the lack of a clear will led to months of stress and family disputes. It was a tough lesson one that showed me how crucial it is to have a valid will in place.

Making a will Ireland isn’t just for the wealthy or elderly. It’s a practical step that gives you control over who inherits your estate and ensures your loved ones are protected. Without a will, the law decides who gets what under the Succession Act 1965, and that might not reflect your true wishes.

In this guide, I’ll walk you through everything you need to know about making a will Ireland from understanding the legal requirements to the step-by-step process. Whether you’re curious about the cost of making a will Ireland or wondering if you can make a legal will without a solicitor, I’ve got you covered. Let’s take things one step at a time to make this simpler.

What Is a Will and Why Is It Important?

A will is a legal document that says what happens to your belongings after you die. It’s your way of making sure your loved ones get what you want them to have. Think of it like leaving behind a map that guides your family through a difficult time. Without it, things can get messy fast.

I remember a neighbor who passed away suddenly without a will. His family thought everything would go to his wife, but the law had other ideas. The estate got divided in ways no one expected, causing tension and legal headaches. It was a tough reminder: if you don’t decide, the law will do it for you and not always the way you’d want.

Why should you have a will?

If you’re over 18 and own anything a house, savings, even sentimental items you should have a will. It doesn’t matter if you’re single, married, or somewhere in between. Without a will, the law decides who gets your stuff under the Succession Act 1965. And guess what? The law doesn’t know your family dynamics or personal wishes.

Having a will gives you control. You can decide who inherits your property, who takes care of your kids, and even who handles everything when you’re gone. Plus, it saves your loved ones from legal stress and family disputes during an already emotional time.

What happens if you die without a will in Ireland?

Dying without a will called “dying intestate” means your estate is divided according to strict legal rules. For example:

- If you leave a spouse but no children, your spouse gets everything.

- If you leave a spouse and children, your spouse gets two-thirds, and the rest is split among your kids.

- If you’re unmarried with no kids, your estate may go to distant relatives or even to the state.

These rules don’t consider personal relationships or unique family situations. Without a will, you lose the power to decide who gets what, and that can lead to long legal battles and broken relationships.

How to Make a Will in Ireland (Step-by-Step Guide)

Making a will in Ireland might sound complicated, but it’s easier than you think. It’s simply about putting your wishes on paper to protect the people you love. I’ve seen firsthand how having a clear will can save families from heartache. Let’s divide it into manageable steps.

Step 1: Decide What to Include

Make a list of everything you possess first. This could be your home, bank accounts, cars, jewelry, or even sentimental items. Think about:

- Property: Your house, land, or any other real estate.

- Savings & Investments: bank accounts, shares, and pensions.

- Personal Belongings: family heirlooms, jewelry, or collections.

- Digital Assets: Online accounts or cryptocurrency.

Quick tip: Be specific. If you want your grandmother’s ring to go to your daughter, write it down clearly. This avoids confusion later.

Step 2: Choose Your Beneficiaries

A beneficiary is simply the person (or people) who will inherit your stuff. You can leave assets to your spouse, civil partner, children, friends, or even a charity.

Think carefully who do you want to provide for? And don’t forget to name backup beneficiaries in case someone passes away before you.

I once heard about a man who wanted his niece to inherit his home, but because he didn’t update his will after a family fallout, the house ended up elsewhere. Always keep your will current to reflect your true wishes.

Step 3: Appoint Executors

Executors are the people who carry out your wishes after you’re gone. They handle paperwork, pay debts, and ensure your beneficiaries receive what you’ve left them.

How many executors do you need? In Ireland, you need at least one executor, but it’s smart to appoint two in case one can’t serve. You can have up to four executors if needed.

Choose someone responsible this role involves legal duties and a fair bit of paperwork. Many people pick their spouse, adult children, or a trusted friend. You could also appoint a solicitor for professional help, though this may add to the cost.

Step 4: Draft Your Will

You have two main options when it comes to writing your will:

- Using a Solicitor: This is the safest route. A solicitor ensures your will meets legal requirements and reduces the risk of mistakes.

- DIY Will: Yes, you can write your own will using a “making a will Ireland” template. But be careful small errors could make it invalid.

Can you make a legal will without a solicitor? Absolutely. But if your estate is complex or you want to avoid future disputes, professional advice is worth considering.

Step 5: Sign and Witness Your Will

For a will to be legal in Ireland, you must follow strict rules:

- You (the testator) must sign the will.

- Your signature must be witnessed by two people both present at the same time.

- Witnesses can’t be beneficiaries or their spouses otherwise, they lose their inheritance.

An essential part is the attestation clause, which confirms that your will was signed correctly. Missing this clause could invalidate your will.

I’ve seen cases where wills were contested because of a simple witnessing mistake. Take the time to do it right it’s worth the peace of mind.

Step 6: Store Your Will Safely

Once your will is complete, store it somewhere safe but accessible. Here are a few options:

- With your solicitor (many offer secure storage services).

- In a fireproof safe at home.

- Lodged with the Probate Office in Ireland.

Tell your executors where to find your will they can’t act on it if they don’t know it exists!

Legal Requirements for a Valid Will in Ireland

When it comes to making a will in Ireland, there are a few key legal boxes you need to tick. Missing even one could make your will invalid and that can lead to chaos for the loved ones you want to protect. Let’s break it down, step by step, in plain English.

1. Age Requirement: 18 Years or Older

First things first, you must be at least 18 years old to make a valid will in Ireland. There’s one exception: if you’re married (or in a civil partnership) under 18, you can still make a will.

Think of your will as a roadmap for your belongings. Once you turn 18, it’s a smart move to put your wishes in writing especially if you own property, have savings, or want to provide for someone special.

2. Mental Capacity: Must Be of Sound Mind

To make a will, you need to understand what you’re doing. This means you must:

- Know you’re making a will.

- Understand the extent of your assets.

- Be aware of who might inherit your estate (like family and loved ones).

This sounds straightforward, but it can get tricky. I once heard about a case where a distant cousin challenged a will, claiming the person wasn’t mentally capable when they signed it. The family had to go through months of legal battles. If there are any doubts, getting a doctor’s letter confirming your mental capacity when signing your will is a smart safety net.

3. Presence of Two Witnesses: Must Be Present at the Same Time

Here’s a crucial point: you must sign your will in front of two witnesses, and they must both be present at the same time. This rule exists to prevent fraud or misunderstandings.

Quick tip: Your witnesses can’t be anyone who benefits from your will (or their spouses). If they are, they lose their inheritance. So, choose neutral, trustworthy people friends, neighbors, or work colleagues often work well.

4. Attestation Clause: Why It Matters

An attestation clause is a simple but vital statement confirming that your will was signed correctly. Without it, your will might not hold up in court.

It typically says something like, “This will was signed by [your name] in our presence, and we signed as witnesses in [their] presence.”

I once met someone who thought they had a valid will, but because the attestation clause was missing, it was declared invalid. Their family had to rely on intestacy rules and the outcome wasn’t what the person had wanted. Small details matter, especially with legal documents.

Costs of Making a Will in Ireland

Let’s talk money. How much does it really cost to make a will in Ireland? Well, the answer depends on how you choose to do it. Whether you go the professional route with a solicitor or take the DIY path, understanding the costs upfront can save you from surprises later.

How Much Does It Cost to Make a Will in Ireland?

If you decide to work with a solicitor, you’re looking at anywhere between €150 and €300 for a straightforward will. More complex estates (think multiple properties, business assets, or international elements) can push the fee higher. While that might seem like a lot, consider this: A well-drafted will can prevent costly legal battles and family disputes down the line.

I know someone who thought a DIY will was enough. But when a family disagreement arose, the vague wording in that homemade document led to a court case costing thousands. That’s why paying a professional for clarity and peace of mind is often a smart move.

Can I Make a Will for Free in Ireland?

Yes, it’s possible to make a will for free in Ireland in certain situations. Some charities offer free will-writing services if you agree to leave them a donation. Additionally, Free Wills Week (usually in October) allows you to create a basic will at no charge through participating solicitors.

You can also draft your own will using a template, which costs nothing but your time. However, be careful. Small mistakes can make your will invalid. If you go this route, double-check that it meets the legal requirements: being over 18, having sound mental capacity, and ensuring two witnesses sign it correctly.

DIY Wills vs. Professional Services: Which Is Better?

So, should you write your own will or hire a solicitor? It depends on your situation.

- DIY Wills: Ideal if your assets are simple, like a single property and clear beneficiaries. They cost little to nothing but carry risks if not done properly. A mistake could invalidate your entire will.

- Professional Services: Best for complex estates or if you want extra peace of mind. Solicitors ensure your will meets all legal standards and can provide tailored advice. Yes, it costs more upfront, but it can prevent bigger headaches later.

I always tell people: If your situation is even a bit complicated, get professional help. It’s a small price to pay for protecting the people you care about most.

What Happens If You Die Without a Will (Dying Intestate)?

Dying without a will in Ireland is like leaving behind a puzzle with no picture to guide your loved ones. The law steps in and decides who gets what and the results might not align with your wishes.

Who Inherits If You Leave a Spouse or Civil Partner but No Children?

If you die without a will and you have a spouse or civil partner but no children, they inherit everything. This might sound straightforward, but without a will, there can still be delays and extra paperwork for your loved one.

Civil Partner and Children: Who Gets What?

Here’s where it gets more complicated. If you leave a spouse or civil partner and children, the law splits your estate:

- You leave two-thirds of your estate to your spouse or civil partner.

- Your children share the remaining one-third equally.

This legal formula doesn’t account for family dynamics. If you wanted to leave specific items for your children or protect a vulnerable family member, the law won’t automatically do that.

I knew a family where this exact situation caused friction. The deceased intended for the family home to go solely to the spouse, but without a will, a portion legally had to go to the children. It created unnecessary tension during an already emotional time.

If No Immediate Family Exists, What Happens?

If you die intestate with no spouse, civil partner, or children, your estate goes to your closest living relatives. This follows a strict hierarchy:

- Parents (if alive).

- Siblings (or their children if siblings are deceased).

- Nieces and nephews.

- More distant relatives (aunts, uncles, cousins).

And if no eligible relatives exist? Your entire estate goes to the state. Imagine working your whole life and having your hard-earned assets go to the government simply because you didn’t make a will.

Why You Should Take Action Now

No one likes to think about their mortality, but making a will is one of the most responsible things you can do. It gives you control, protects your loved ones, and reduces stress during difficult times. Don’t leave your legacy to chance start the process today and ensure your wishes are honored.

Inheritance Tax (Capital Acquisitions Tax) and Wills

Let’s talk about inheritance tax or, as it’s officially called in Ireland, Capital Acquisitions tax (CAT). It’s one of those things that people often overlook until it’s too late. But understanding it now can save your loved ones from unexpected financial headaches later.

What Is Capital Acquisitions Tax (CAT)?

In simple terms, CAT is a tax on gifts and inheritances. If someone leaves you property, money, or other assets when they die, you may have to pay tax on what you receive.

Here’s how it works:

- If the total value of what you inherit goes over a certain limit (called a tax-free threshold), you’ll owe tax on the extra amount.

- Ireland currently has a 33% inheritance tax rate. That means for every €1,000 above the tax-free limit, €330 goes to Revenue.

I once knew someone who inherited a family home, thinking they were set for life until a hefty tax bill arrived. A little planning could have saved them a lot of stress. To give you an idea of what to anticipate, let’s examine the figures.

How Much Inheritance Tax Applies to Spouses, Civil Partners, and Children?

Not everyone pays the same amount of tax. Your relationship with the deceased determines how much you can inherit tax-free.

Here are the current tax-free thresholds (as of 2024):

- Group A: €335,000 – This applies if you’re a child (including adopted, step, or foster children) inheriting from a parent.

- Group B: €32,500 for siblings, nieces, nephews, grandchildren, and other close relatives.

- Group C: €16,250 – For everyone else (friends, distant relatives, etc.).

✅ Good News: Spouses and civil partners don’t pay any inheritance tax no matter how much they receive. This can be a huge relief for couples.

Let’s say you leave your child a home worth €500,000. The first €335,000 is tax-free. But the remaining €165,000 is taxed at 33%, meaning they’d owe €54,450 in tax. That’s a big chunk of change if you’re not prepared.

Tips to Reduce Inheritance Tax Liability

Nobody enjoys paying more taxes than necessary. Luckily, there are smart ways to reduce the inheritance tax burden. Here are some practical tips:

- Gift Assets Early: You can gift up to €3,000 per person, per year tax-free. Over time, these small gifts add up and can lower the value of your estate.

- Use the dwelling house exemption: If a beneficiary lives in your home for three years before your death and continues living there for six years after, they may avoid paying inheritance tax on the property.

- Leave assets to Your Spouse or Civil Partner: Since they’re exempt from inheritance tax, transferring property or assets to them can be a tax-efficient move.

- Consider a Life Insurance Policy: Called a Section 72 policy, it can be used specifically to cover inheritance tax. This can be a lifesaver for beneficiaries who might otherwise struggle to pay.

- Work with a Solicitor: Professional advice is worth it especially if your estate is complex. A solicitor can guide you through tax-saving strategies and ensure your will is structured properly.

I always say a little planning now can save a lot of heartache later. Take the time to review your estate and talk to a professional if you’re unsure. Your loved ones will thank you.

Common Problems and Disputes About Wills

Wills are supposed to make things easier. But sometimes, instead of providing clarity, they lead to family disputes and legal battles. Let’s talk about the common problems people face and how to avoid them.

Disputes Over the Legal Right Share Under the Succession Act 1965

In Ireland, the Succession Act 1965 protects certain family members especially spouses and children. You can’t completely disinherit them without a valid reason.

Here’s how it works:

- Spouses: By law, a surviving spouse is entitled to a share of your estate.

- If you die with children, your spouse gets one-third of the estate.

- If you die without children, your spouse gets everything.

- Children: While there’s no guaranteed portion for children, they can challenge the will if they feel they’ve been unfairly excluded or inadequately provided for.

I’ve seen families torn apart because someone was left out of a will. Even if you have reasons for excluding a loved one, consider explaining your decision clearly in writing or through a solicitor to reduce the risk of a legal challenge.

Challenges to Mental Capacity or Undue Influence

Another common dispute involves questions about mental capacity or undue influence. If someone argues that the person who made the will wasn’t of sound mind or was pressured into making certain decisions, they can contest the will.

To protect your will from being challenged:

- Document your mental capacity: If there are any concerns, get a medical professional to confirm you were mentally capable when making your will.

- Avoid undue influence: Make sure your decisions are your own free from pressure by family members or caregivers.

I remember hearing about a case where a caregiver convinced an elderly man to change his will, leaving everything to her. The family successfully contested it, but the legal battle took years. Don’t let that happen to your loved ones.

How to Resolve Family Disputes Over a Will

Family disagreements over wills can get ugly but they don’t have to. Here are some steps to resolve disputes peacefully:

- Communicate Clearly: Be upfront with your loved ones about your intentions. Surprises often lead to hurt feelings and legal fights.

- Use Mediation: If tensions arise, a neutral mediator can help family members find common ground without going to court.

- Keep Your Will Updated: Life changes your will should too. Review it regularly, especially after major events like marriage, divorce, or having children.

- Consult a Solicitor: Professional advice can prevent disputes by ensuring your will is legally sound and reflects your true wishes.

At the end of the day, a well-prepared will isn’t just about money it’s about protecting your family from unnecessary conflict. Taking the time to get it right is one of the best gifts you can leave behind.

Conclusion

Making a will Ireland might not be the most exciting task, but it’s one of the most important things you can do for your loved ones. Without a clear will, your family could face legal headaches, emotional stress, and even disputes over your assets.

Think of a will as your voice when you’re not there to speak. It gives you the power to protect your family and ensure your wishes are honored. Whether you choose a solicitor or go the DIY route, the key is to get started today. Life is unpredictable—and a will is your way of saying, “I’ve got this covered.”

So, why wait? Take the first step today and give yourself and your loved ones peace of mind. You’ll thank yourself later—and so will they.

How many executors are needed for a will in Ireland?

In Ireland, you need at least one executor to manage your will, but it’s often wise to appoint two—just in case one is unavailable. The law doesn’t set a maximum number, but having more than three can make things complicated. Think of executors as your trusted team who ensure your wishes are followed. It’s like leaving the keys to your life’s work with people you trust completely.

Can I make a will without a solicitor?

Yes, you can make a legal will in Ireland without a solicitor. There are DIY will kits and templates available. But here’s the catch: a simple mistake (like an unsigned section) can make your will invalid. If your estate is straightforward, a DIY approach may work, but for more complex situations (like property or business assets), a solicitor provides peace of mind.

What makes a will invalid in Ireland?

A will can be invalid if:

It’s not signed or witnessed correctly.

You were not of sound mind when making it.

There was undue influence (someone pressured you).

It doesn’t follow the legal requirements under the Succession Act 1965.

One small error can cause big problems for your loved ones. So, double-check the details—or better yet, get legal advice to be sure.

Can I change or update my will later?

Absolutely! Life changes—and so should your will. Whether you’ve had a new baby, bought a home, or gone through a divorce, you can update your will anytime. You can either create a codicil (an official amendment) or draft a new will altogether. Just make sure the updated version is properly signed and witnessed.

Is a handwritten will legal in Ireland?

Yes, a handwritten will (also called a holographic will) is legal in Ireland if it meets these conditions:

You are of sound mind and at least 18 years old.

It is signed by you and two witnesses (who are present together).